virginia estimated tax payments corporate

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. Pursuant to 581-4003 of the Code of Virginia certain electric suppliers are required to pay a minimum tax rather than a corporate income tax for any taxable year their minimum tax.

When Are Taxes Due Tax Deadlines For 2022 Bankrate

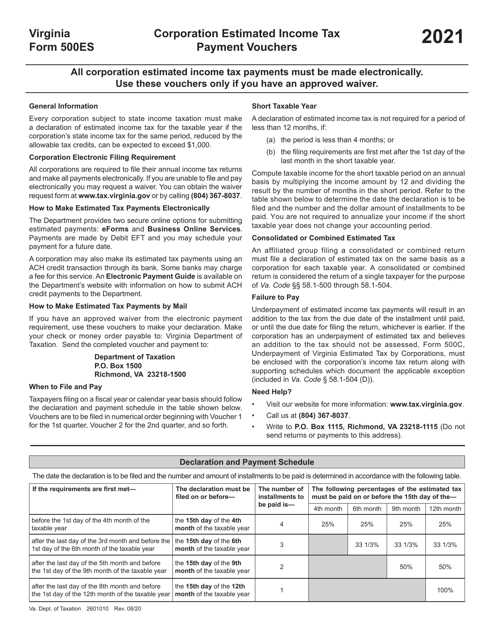

Use these vouchers only if you have an approved waiver.

. Please enter your payment details below. Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management. Virginia Department of Taxation PO Box 26627 Richmond VA 23261-6627.

Ad Reduce Risk Drive Efficiency. See it In Action. Taxable Payment Amount of Corporate Net Income Tax Payment.

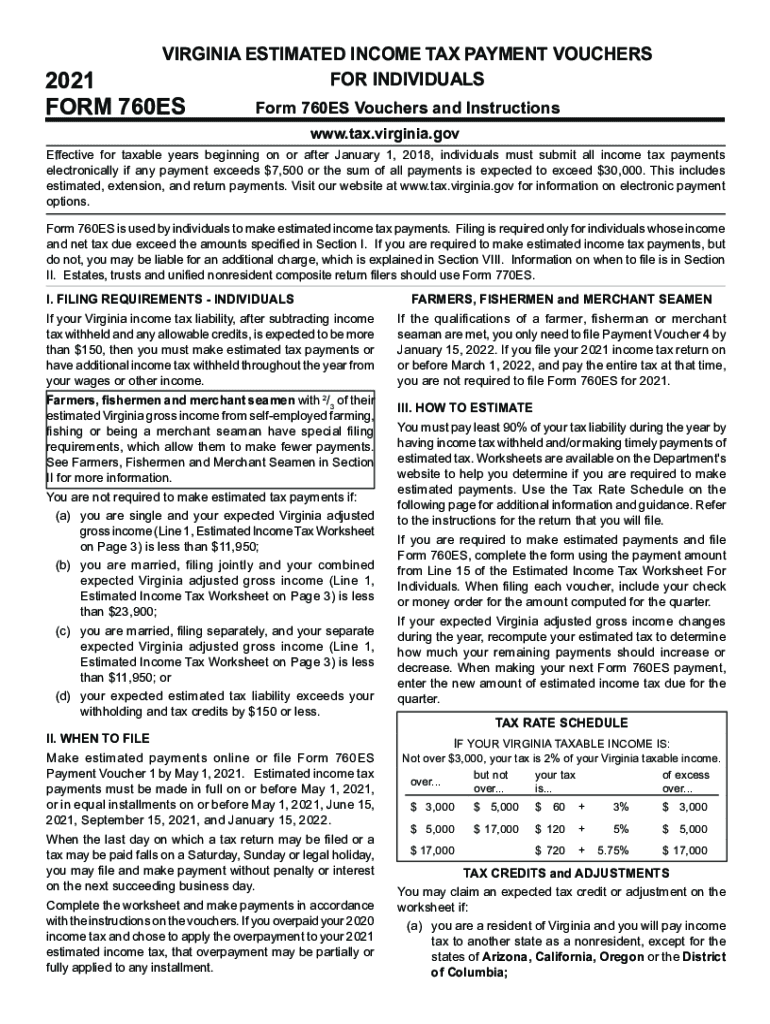

Make tax due estimated tax and extension payments. Electronic filing is mandatory if the following applies. Please note a 35 fee may be assessed if your payment is declined by.

Ad Access Tax Forms. Annual income tax return. Sales Use Taxes and Cigarette Tobacco Taxes.

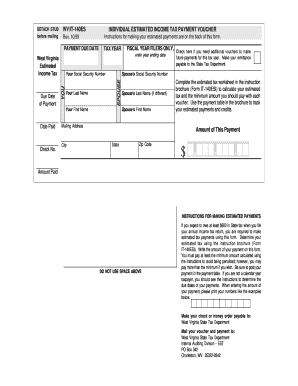

CORPORATE NET INCOME TAX PAYMENT WEST VIRGINIA ESTIMATED WVCIT-120ES rtL066 v4 Account ID. Use the same taxable year and method of accounting as you use for Federal Tax Purposes. Attach to your West.

Any installment payment estimated tax exceeds 1500. How to make estimated tax payments electronically the department provides two secure online options for submitting estimated payments. Click iat notice to review the details A handful of states have a later due.

Complete Edit or Print Tax Forms Instantly. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. Richmond Virginia 23218-1478.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. All corporation estimated income tax payments must be made electronically. Please enter your payment details below.

Please enter your payment details below. Request Your Demo Today. Please enter your payment details below.

Certain Virginia corporations with 100. Use electronic funds transfer to make installment payments of estimated tax. Pay bills or set up a payment plan for all individual and business taxes.

At present Virginia TAX does not support International ACH Transactions IAT. All corporation estimated income tax payments must be made electronically. Click IAT Notice to review the details.

File your West Virginia CIT-120 electronically. Code 1950 58-15139. Ad Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now.

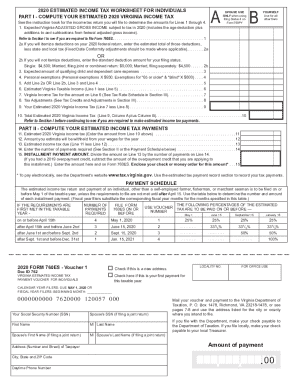

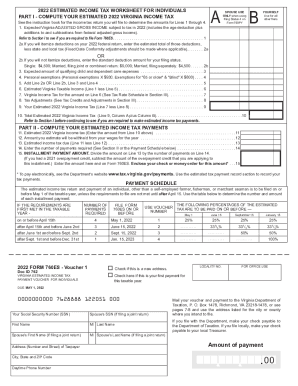

Corporation Estimated Income Tax. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. Use Form 1120-W Estimated Tax for Corporations as a worksheet to calculate your estimated.

Virginia Estimated Tax Declaration For. All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products. Every corporation required by this article to file a declaration of estimated income tax shall file the same with and make payment to the Department.

Any payment made for an. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now.

Virginia estimated tax payments corporate thursday april 21 2022 edit.

760es 2019 Fill Out Sign Online Dochub

/cloudfront-us-east-1.images.arcpublishing.com/gray/UNSGWR4LMBGNBEFQKHBLN7LMFA.jpg)

West Virginia State Tax Department Reopens For In Person Customer Service

West Virginia Estimated Tax Form Fill Out And Sign Printable Pdf Template Signnow

Www Tax Virginia Gov2021760c 20212021 Form 760c Underpayment Of Virginia Estimated Tax By Fill And Sign Printable Template Online Us Legal Forms

Individual Estimated Tax Payments Virginia Tax

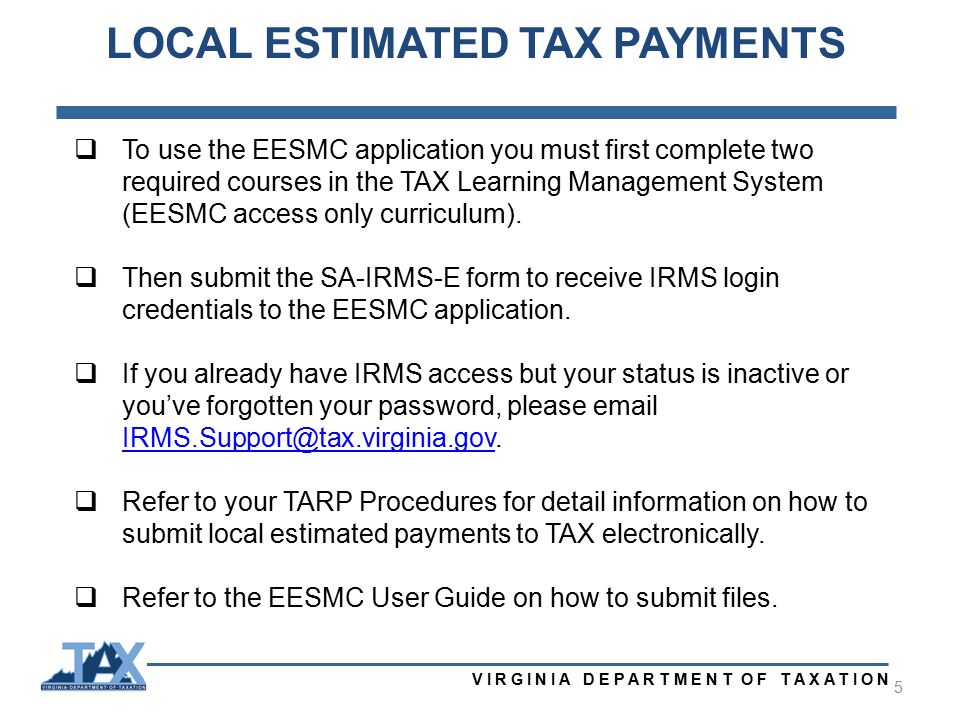

Treasurers Association Of Virginia Virginia Department Of Taxation 1 Local Estimated Tax Payments Howard Overbey Tax Processing Manager June 23 Ppt Download

Corporate Tax Accountant Resume Samples Qwikresume

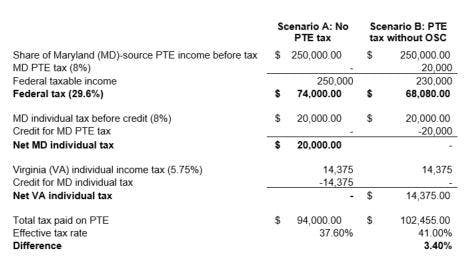

Pass Through Entity Tax 101 Baker Tilly

Updated What Tax Filings And Payment Deadlines Have Been Extended By The Irs And The Virginia Department Of Taxation Sands Anderson Pc Jdsupra

2021 Form 760es Fill Out And Sign Printable Pdf Template Signnow

Virginia Department Of Taxation Government Organization Facebook

Treasurers Association Of Virginia Virginia Department Of Taxation 1 Local Estimated Tax Payments Howard Overbey Tax Processing Manager June 23 Ppt Download

Treasurers Association Of Virginia Virginia Department Of Taxation 1 Local Estimated Tax Payments Howard Overbey Tax Processing Manager June 23 Ppt Download

Treasurers Association Of Virginia Virginia Department Of Taxation 1 Local Estimated Tax Payments Howard Overbey Tax Processing Manager June 23 Ppt Download

Virginia Estimated Tax Payments Fill Out And Sign Printable Pdf Template Signnow

1958 Blue Hills Golf Corporation Dewey W Henry Churchill Drive Roanoke Virginia Ebay

The 35 Percent Corporate Tax Myth Itep

Virginia Department Of Taxation Virginia Tax Reminder Individual Estimated Tax Payments Are Due On June 15 More Info Https Www Tax Virginia Gov Individual Estimated Tax Payments Facebook